Jet.com officially launched yesterday. The retailer can potentially shake up commerce as we know it. Historically, retailers have focused on select control points for strategic differentiation.

- Location: You have often heard of the “location, location, location” mantra in (offline) retailing.

- Selection: Assortment, breadth of brands, categories, products, prices, focus on quality, etc.

- Customer service: Imagine the experience of buying a bike at a local bike retailer versus buying one at one of the big stores.

- Price: EDLP, promotion-driving pricing, value-based pricing, etc.

With the growth of digital and advent of Amazon, additional dimensions of strategic competition and new competencies emerged:

- Data: What does the retailer know about the shopper? Competition? Changing consumer mega and micro trends? Inventory levels?

- Algorithms and technology: How does the retailer leverage aforementioned data to power applications on the demand side (personalized experiences, prices, promotions, offers, tracking, etc.) and the supply side (supply chain, operational efficiencies, drop shipments, etc.)?

Despite the hectic double-digit growth in e-commerce revenues worldwide, with the exception of select pricing innovations such as Priceline.com, e-commerce has remained largely unchanged in the last 20 years. Jet.com could potentially change the status quo. Jet.com has borrowed an old and simple idea from the membership model espoused by predominantly offline retailers such as Sam’s Club and Costco, where subscriptions drive retailer margins. Add in a sprinkling of data, a dash of algorithms, and a shot of technology and Jet.com can revolutionize the consumer experience and become a formidable competitor. The key strategic shift – imagine a retailer focused on finding the best price for whatever the member would like to buy, i.e., “Jet.com works for our members.” Jet.com, supposedly, will do the hard work of continuously monitoring prices, thus eliminating the search costs for consumers, and, for this benefit, the consumer is willing to pay an annual membership fee. The CEO of Jet.com went a step further claiming that ad revenues (on Jet.com) from retail partners will be returned to Jet’s members by offering consumers even lower prices.

Then the key question is whether Jet.com can continuously monitor prices for any product and ensure that the price paid by its member is lower than any competitor at the time of purchase. Anecdotal evidence suggests that this is a herculean task, and matters will only get worse as dynamic, personalized pricing (either determined by the retailer through algorithms or pay-what-you-wish pricing wherein the price paid is determined by the shopper) will be more commonplace (more on price differentiation in a later post).

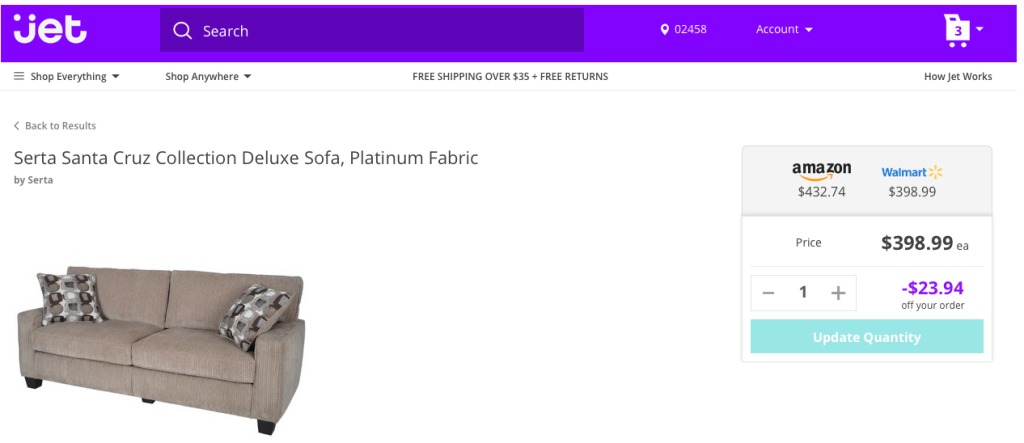

I was looking to buy a sofa and decided to start with Jet.com. Here is the snapshot of the product page on Jet.com. It surfaced the Amazon price at $432.74 and Walmart.com price at $398.99, claiming an additional savings of approximately $24. I moved on to check the prices at Walmart.com and Amazon.com concurrently.

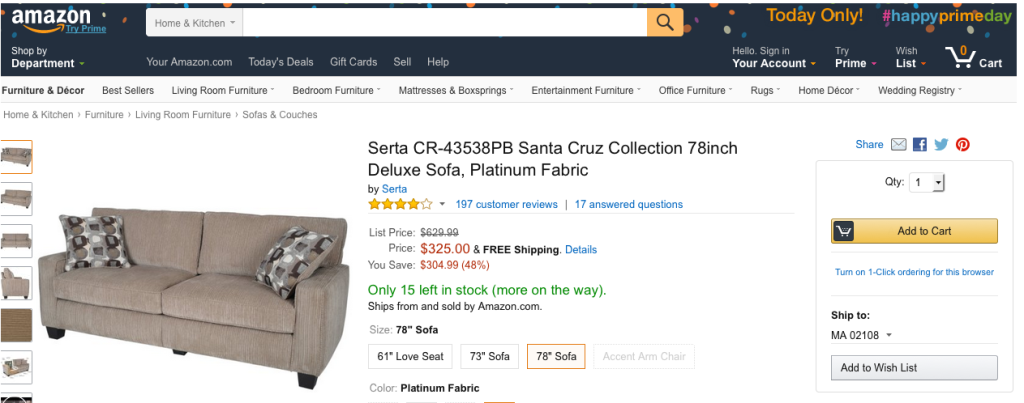

On Amazon.com, a search lead to the exact product priced at $325, which is more than $100 below the Amazon’s price surfaced on Jet.com. Strike 1.

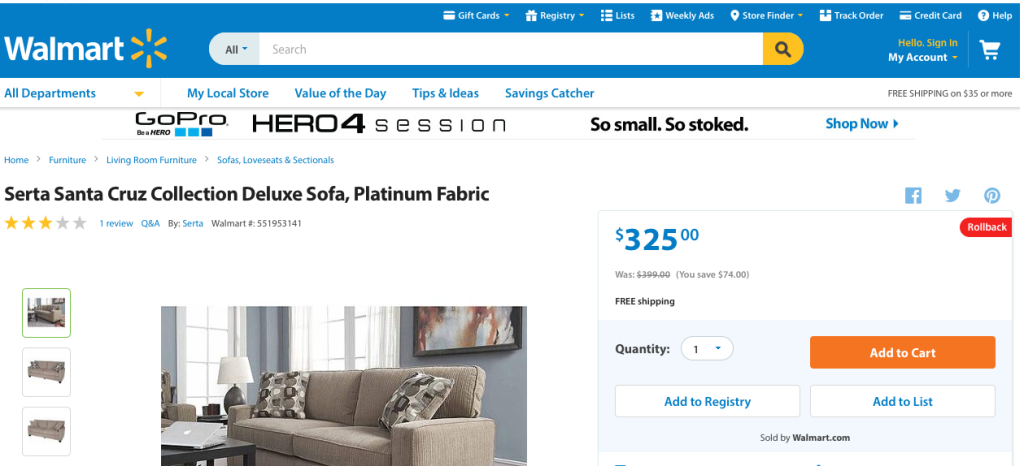

On Walmart.com, the sofa was priced at $325, which is $75 below Walmart’s price surfaced on Jet.com. Strike 2.

I am sure Jet.com tried its best to be on top of the prices at Amazon, Walmart and other retailers in its competitive set. Probably the “crawl” of Amazon and Walmart sites was lagging behind by few hours or even a day, and Jet.com is presenting the latest prices as per its database. But in a world of “dynamic” prices, when prices change every 10 minutes at sites such as Amazon, and the prices change could be dramatic (as seen in this anecdotal search), how can Jet.com promise to sell at or below lowest price of any other retailer (or the fixed set of retailers it chooses to price monitor). The truth will come out in coming weeks and months.

PS: Note that I was searching for the sofa on the day of the “Black Friday in July” sale at Amazon (which Walmart copied with its own version of “Rollbacks”), and prices were oscillating at higher amplitude and frequency on that particular day and Jet.com’s system were lagging behind in its competitive price awareness more than on a typical day. When the price discrepancy was raised with the support team at Jet.com, they responded immediately, and blamed it on Amazon’s sale and Walmart’s price matching efforts (note that Jet.com didn’t offer to sell me the sofa at $325). Interestingly, Best Buy announced today that it will have a Black Friday sale starting Friday July 24, and even going a step further by offering a Cyber Monday.