Programmatic buying and precision targeting/marketing ecosystems are enjoying phenomenal growth, and is expected to capture 80% of the online display/mobile/video ad market by 2018. It is just a matter of time (1-2 years) before the same buying principles/mechanism will capture bulk of TV, radio, digital billboard, and other buys. The digital ad technology stack is complex with stringent latency requirements for making a myriad of decisions within 10s of milliseconds. But ad tech fails miserably in a very simple, but frequently occurring, use case:

- A shopper goes to an online retailer and considers some products, conducts some searches, etc.

- Shopper is interrupted by a tweet, a text, email about a breaking news story ( or a crying baby)

- Shopper goes to cnn.com to learn more.

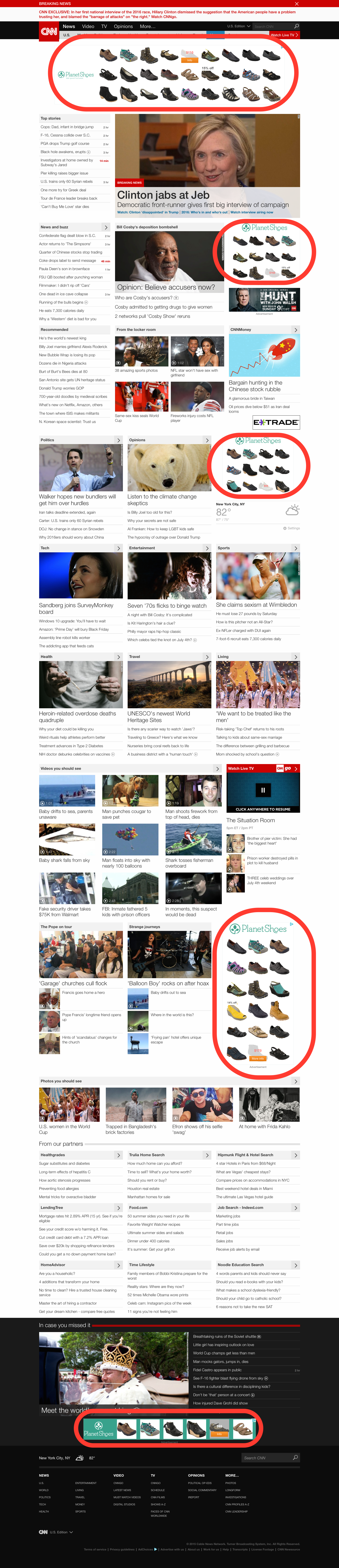

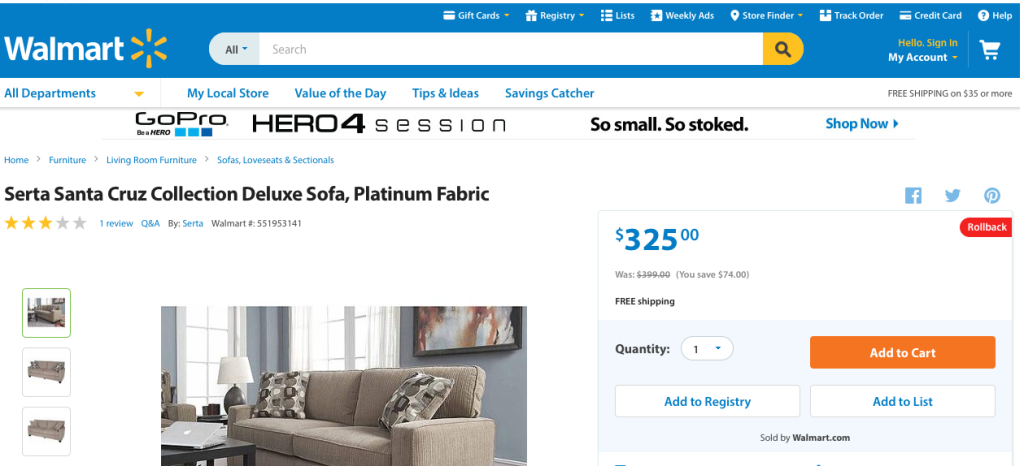

- Every ad on cnn.com is from the online retailer (see below from a recent personal experience).

Naturally many questions arise in this mundane setting:

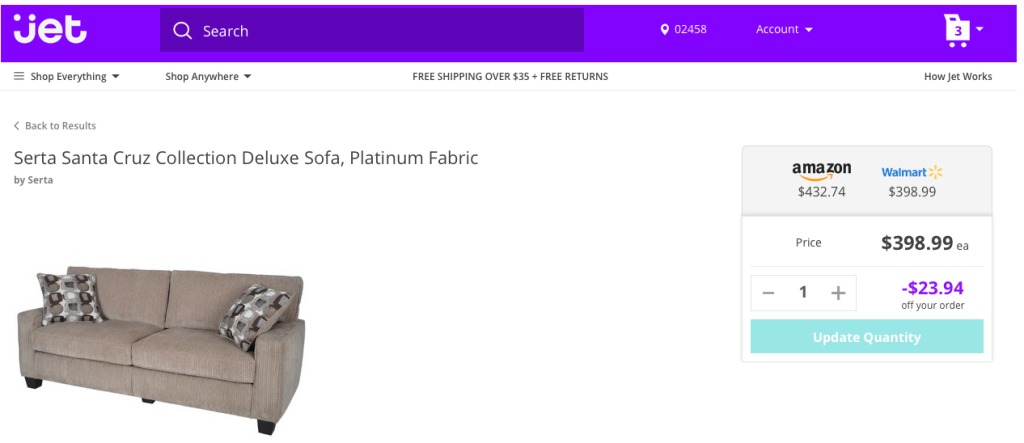

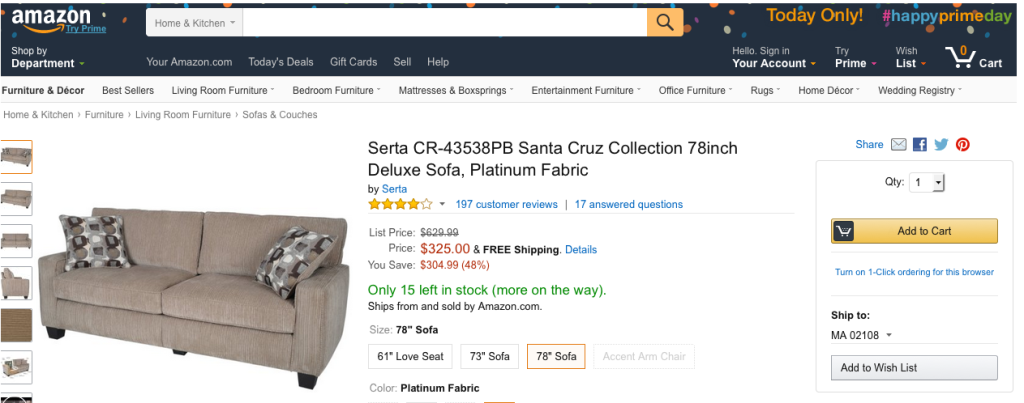

- Conversion credit: Should the retargeting vendor (Criteo in this case) be credited with a conversion if a sale occurs? Remember, my “other” tab still points to the retailer and I am actively shopping.

- Overpayment: If it was an impression-based buy, then did the retailer pay Criteo unnecessarily? Maybe for 1 or 2 impression, but not for all 5.

- Ecosystem complexity: Criteo, after flexing its math muscle, determined that serving me a retargeted ad is economically advantageous (aka ROI) for the retailer and bid for the spot. Criteo chanced to bid and win independently for each of the 5 spots on the same page. Should Criteo be blamed for the situation? Note how each of the 5 spots hopped through multiple exchanges and networks as hot potatoes in milliseconds, while cnn.com is still serving up the page, all in parallel with 10s, 100s or 1000s of bidders bidding for each spot in real-time. More importantly, Criteo can’t be sure whether it would win any, some, or all of the spots, or reliably know the ad page domain or URL (due to deliberate and accidental obfuscations inherent in the ecosystem).

- Intent: Every one thinks (or claims) that recency of behavioral markers plays a critical role in driving ad performance, but should the time dimension for intent be measured in seconds, minutes, hours or days? It depends on many factors such as the product category, complexity of the consumer decision. intent’s TTL/expiration, etc.

So what is missing in ad tech – common sense. Ad ecosystem players are having heated and fruitless debates on viewability, transparency, and standardization of associated metrics (should online display viewability be measured as half the ad’s pixels potentially “viewable” for 1 second, half a video ad played, etc., which are similar to TV’s “opportunity to see” notions), but I venture that the discussion should instead focus on:

- Ad fraud (no one gains except the fraudsters)

- Long-term and short-term impacts: Incremental brand (will the buy influence and change the target’s perceptions of the brand) and ROI (will the target change behaviors) metrics vis-a-vis a “no buy.”